Electronic Vehicle Log Book Australia

Accompanied by test sheets in section 1 of the. Our Electronic Logbook solution provides a simple and convenient way to automate your vehicle operating cost tracking and minimise your fringe benefits expense.

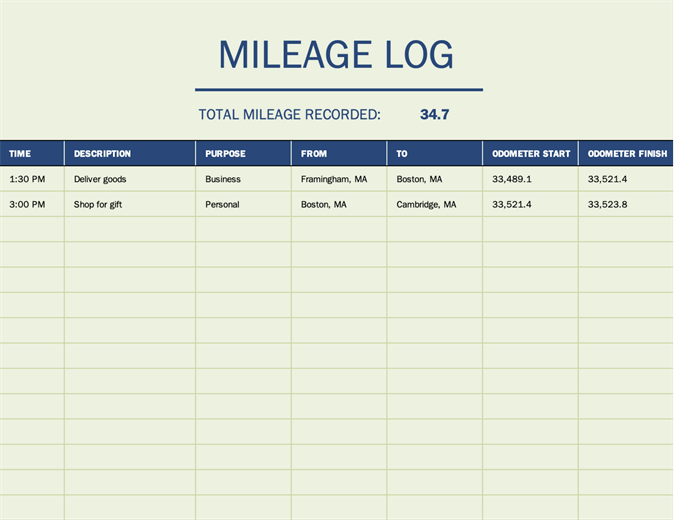

The Logbook Method How To Claim Car Expenses Free Logbook Template

ATO Compliant Logbook App by GOFAR App 1.

Electronic vehicle log book australia. The ATO approved not just compliant GPS Log Book refer to ATO CR20142 for our class ruling. ATO Vehicle Log book is fully compliant with Australian Tax Office requirements where the logbook method is used to claim the percentage business use of a vehicle. Wildon 86W Vehicle and Business Expenses Log.

Now well get into the detailed specs and features for each of the vehicle log book apps. By using a logbook your tax deduction claim is based on your cars business use percentage. Add to My List.

Sync on-line to output ATO tax logbooks employee travel claims and a host of other data exports. If you have evidence youve held an interstate learners permit your Qualified Supervising Driver may include that previous driving experience in your log book. View and manage your business and personal trips in detail on Google maps.

An electronic or pre-printed logbook available from stationery suppliers evidence of your actual fuel and oil costs or odometer readings on which you estimate your fuel and oil use evidence of all your other car expenses. Also an electrical safety certificate is not required if the electrical contractor has submitted the required preliminary and final notices and made a declaration eg. Add to My List.

Instead the electrical contractor may submit preliminary and final notices for notifiable work and use the electrical log book to record final sub-circuit alterations. The following companies have been approved to provide Electronic Work Diaries. The records you need to keep are.

Drivers are not allowed to drive or work more than the maximum work hours or rest less than the minimum rest hours in a certain period set out by law. EzyCarlog is simply Australias Easiest Car Log Book EzyCarLog is the ultimate answer is providing its users a simple user interface supported by dynamic technology and processing power to ensure all record details are fully and completely captured. Available to install as an App on your mobile device Work Diary Mates design is based on the Australian National Driver Work Diary for Heavy Vehicles so you will know how to use it straight away.

An Electronic Work Diary EWD is an electronic device or system approved by the NHVR to monitor and record the work and rest times of a driver and is an alternative to the written work diary. Dont be one of those people this year. Our goal is to help you choose an app that ultimately helps you track your ATO work-related expenses.

GOFAR is an advanced affordable logbook app and mileage tracker that. FBT Compliance Where your employer requires you to. The expense tracker and logbook templates on this page will save you heaps of time and money.

Please note the conditions of approval for each of. You may also use an electronic learner log book app to record your driving hours instead of recording them manually in your Driving Companion. A log checker for the Truck or Bus Driver Work Diary Mate is the easiest and most intuitive work diary assistant and log book checker there is.

Keeping a vehicle log book layouts in an electronic structure can bring bunches of advantages for the proprietor or an owner. The National Driver Work Diary also know as a log book is evidence that a drivers work and rest hours are compliant with the Heavy Vehicle National Law HVNL and that their fatigue is being managed. Use these resources and youll get the best tax refund possible on your next tax return.

A greatly manufactured spreadsheet intended for the log book is an extraordinary apparatus for keeping yourself overhauled on your vehicles execution. Throughout this 12-week period you have to document every business related journey that you make in your car. If yes tracking your mileage and deducting your Australian Tax Office ATO.

Zions Pocket Vehicle Log and Expenses Record Book. Zions SBE10 Vehicle Log and Expenses Book. A vehicle log book is an important piece of tax substantiation for people who use their car for work.

Electronic Service Log Book Histories BM Tech can now update the service log book on BMWs and Minis which use the electronic cloud-based log book service. A vehicle logbook is a record of the total number of business kilometers you have travelled over a minimum of a 12-week period. Most people will be familiar with the two main instances where a vehicle log book is required.

Simply plug the GPS Log Book into your cars cigarette lighter and automatically record every trip. As the number of Australians making work related car expenses continues to rise the Australian Taxation Office ATO requires logbooks to be kept. Commonly Australians leave money they genuinely deserve in the ATOs pockets each years simply because they dont have the right evidence to support a claim.

Elogbook Easy To Use Log Book Solution Ato Compliant Buy Now

My Licence The Driving Companion Daytime Forms

What S The Importance Of A Vehicle Logbook Gofar

Log Book Method Atotaxrates Info

Keeping A Vehicle Log Book Synectic Group

Zlev Road User Charge Vicroads

The Best Car Logbook App In Australia Detailed Review Of 5 Gofar

![]()

Vehicle Logbook Template Other Expense Tracking Resources

21 Printable Logbook Format For Vehicle Templates Fillable Samples In Pdf Word To Download Pdffiller

Vehicle Logbook Templates Gofar

Ato Approved Logbook Apps Afs Associates

Motor Vehicle Logbook Tutorial Youtube

Log Book Template Book Template Templates Word Template

Motor Vehicle Logbook Tutorial Youtube

Haynes Log Book And Vehicle Expenses 01417 Supercheap Auto

![]()

Ato Vehicle Logbook On The App Store

Post a Comment for "Electronic Vehicle Log Book Australia"